Each employer or deductor who deducts TDS (Tax Deducted at Source) from your compensation/salary is committed to store it with the income tax department against your PAN. In any case, now and then, they neglect to do as such. If such a thing happens the taxpayers gets in between and demands the tax payer to clear of the balanced tax as well as inform the deductor to deposit the tax that has been already deducted.

What is TDS?

It is a shortening for Tax Deducted at Source. It was acquainted with a point to deduct the tax from the income. In a perfect world, it is the obligation of your manager to deduct this duty from your salary specifically. In this manner, guaranteeing that the assessment is kept with the legislature.

How does TDS function?

The substance that makes the instalment deducts a level of the sum paid, as assessment and pays the parity to the beneficiary. The beneficiary gets an authentication expressing the measure of TDS paid. The deductor will undoubtedly store the TDS with the administration. When the sum is gotten it will reflect during the 26AS form.

How would you realize that your TDS has not been saved?

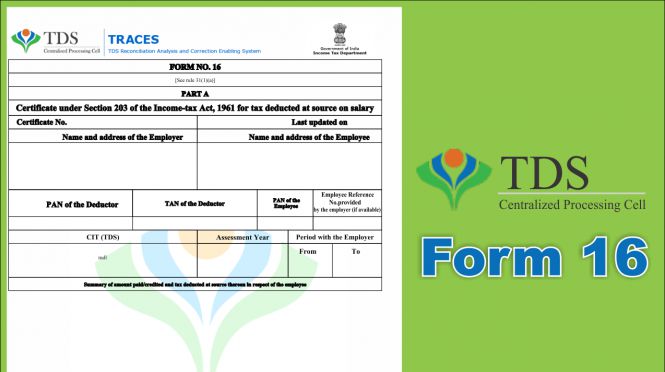

To know your aggregate expense payable, you have to subtract TDS, referenced in the TDS testament (Form16 or Form 16A) from your aggregate duty risk. This could even be extra duty because of pay, a discount or no assessment by any means. Your TDS should likewise coordinate the division’s record which is reflected in Form 26AS. In the event that the sum in your TDS testament does not line up with the IT office’s records, it is an indication that something is wrong.

Now and again, if thecompany does not issue TDS declarations at all and it just goes to the representative’s notice through compensation slip passages or as short instalment of pay.

What would you be able to do in such a circumstance?

The main thing you ought to do is convey it to the notice of your manager and demand him to do the needful, before the due date. In the event that, the manager does nothing about it and does not address the issue, you have the privilege to approach the assessment experts.

Fortunately, the duty division has given reprieve to citizens in such circumstances. The IT department has announced that if such a thing happens than the taxpayer will not be demanded for anything. It further expresses that the duty levy must be recuperated from the company instead.

On the off chance that your manager neglects to make a move with respect to this, you can caution the expense division by making a grievance in keeping in touch with your surveying officer.

Imperative things to note:

Since this issue is concerning the Income Tax Department, you should guarantee that every one of the archives and expected printed material to demonstrate your blamelessness is all together. Here are a few things you should take to note:

Keep up confirmation of TDS conclusion including pay slips, bank explanations and some other archives as proof that TDS has been deducted.

Audit your 26AS and count it with your TDS declaration (Form 16 or 16A) as material, to distinguish and correct any disparities.

Guarantee with your manager that TDS has been deducted against your right PAN. It could happen that you may have furnished your manager with a mistaken PAN. All things considered, ask for your boss to re-examine the equivalent.

Final words

In spite of the fact that it is the business’ obligation to dispatch the deducted assessment to the administration, you should guarantee there is no pending risk in your name. Take plan of action from the redressals given by the Income Tax office, if there should be an occurrence of rebelliousness by the business or deductor.