Emergency or Exit from any company withdraw PF online through UAN Easily : Check Details

Employee provident Fund is a Scheme initiated by Government of India as per Employment provident Fund Act of 1952 where an equivalent amount of PF is contributed by your employer and employee for PF Each Month. As it is deducted on monthly basis it will develop a corpus fund which can be used in emergency and will be helpful to you in retirement. Every time when you change your organisation there is similar UAN (Universal Account Number) will work. The 12 digit UAN number is so much useful to check details of your PF. If you want to check your EPF balance you have to visit the e seva portal of EPFO and log In with your UAN.

Basic Requirement of Online withdrawal of PF

If you want to withdraw your PF online for any wedding or education of your child or home renovation or any emergency you can withdraw partially from your EPF balance. You have to follow a process of withdrawal for that the basic requirement for withdrawing PF online is

1. UAN

2. Aadhaar number is mandatory and it should be linked and verified with UAN.

3. The bank account which you want to receive the amount must be registered with aadhaar.

4. If there are any changes you can complete the ekyc process and can update details prior submitting your claim.

Read More : Now solve your EPF account problem by using Whatsapp Helpline number; Check how

Step By step process of withdrawal of PF

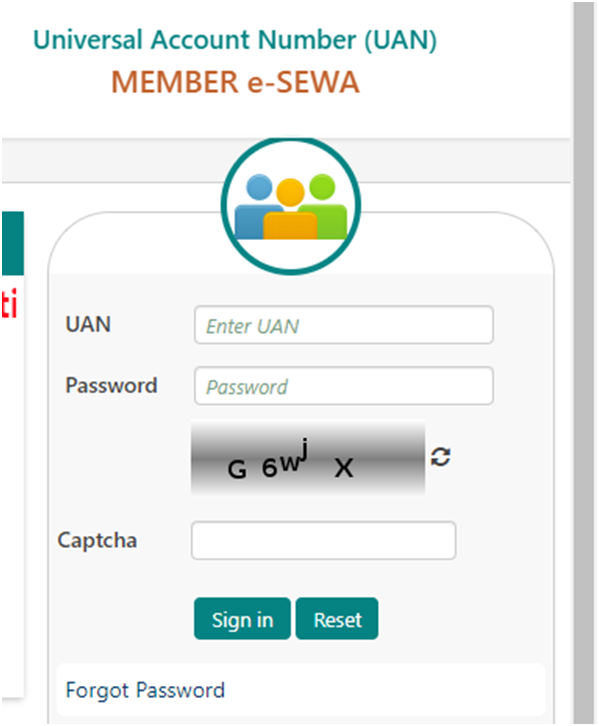

1. First Login in the EPFO e seva Portal and log in with your UAN and Password. In case of password forgot you can reset it via otp sent to your registered mobile number.

2. Click on online claims section and you can look for claim (Form 31, 19, 10c and 10D) in online services section.

3. After opening this section you have to fill the correct bank account number seeded with UAN for verification process.

4. After verifying the details you need to confirm the terms and conditions stated BY EPFO then you can click on the proceed for online claim.

5. Select the reason for withdrawal of PF and enter your complete address and upload your cheque book or passbook details for the option of advance claim. Again you have to accept the terms and conditions and after that OTP will come for verification on your mobile number.

6. Once you will get the OTP on the registered mobile number linked with your aadhaar enter it and your online claim application will get submitted.

You can track the status of your claim by login in the portal again and clicking on track claim status. the EPfo officials will match your data with the records and after completing the verification they will process the claim in to your bank account linked with your UAN.

PF and EPS Withdrawal at different years of service

1. Withdrawing PF balance and EPS amount (for below ten years of service)

If your service period has been less than 10 years both PF balance and EPS amount will be paid.

2. Withdrawing PF balance and EPS amount (over ten years of service)

If you have already completed 10 years of service The EPS amount cannot be withdrawn and only the scheme certificate is to be issued by filing the form 10c and pension is to be paid from age 58 and reduced pension can be paid from age 50.

3. Withdrawing PF balance and reduced pension (age 50-58) (over ten years of service)

if your age is between 50-58 and you have completed 10 years of service you can opt for reduced pension. You have to submit form D with the other PF withdrawal form.

4. Withdrawing PF balance and full pension (After 58)

After 58 you can claim the full pension submit the form 10D for that.